illinois employer payroll tax calculator

This is a projection based on information you provide. Illinois Withholding Tax Tables Booklet - effective January 1 2022 - December 31 2022.

How To Calculate Payroll Taxes Methods Examples More

This procedure only applies to nonresident alien employees who.

. Amended Illinois Withholding Income Tax Return. The standard FUTA tax rate is 6 so your max. What Are Employer Unemployment Insurance Contribution Tax Rates.

2022 Federal Tax Withholding Calculator. Ad Process Payroll Faster Easier With ADP Payroll. State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50.

The Unemployment Insurance Act was recently amended to provide for the personal liability of any officer or employee of an employer who has control supervision or responsibility for the. Box 5400 Carol Stream IL 60197-5400. Get Started With ADP.

Discover ADP For Payroll Benefits Time Talent HR More. Illinois State Disbursement Unit PO. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. An employee can use the calculator to compare net pay with different number of allowances marital status or income. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. You can quickly calculate paychecks for both salaried and hourly employees. Ad Process Payroll Faster Easier With ADP Payroll.

Our paycheck calculator for employers makes the payroll process a breeze. An employer can use the calculator to compute and prepare paychecks. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

Just enter in the required info below such as wage. It is not a substitute for the advice of. Get Started With ADP.

FedState Employment Taxes Program FSET - a program for employers and payroll companies to electronically file and pay both their Federal and Illinois employment taxes. Illinois Salary Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Discover ADP For Payroll Benefits Time Talent HR More. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. This calculator is a tool to estimate how much federal income tax will be withheld.

Use ADPs Illinois Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Just enter your employees pay. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Also these chart amounts do not increase the social security Medicare or FUTA tax liability of the employer or the employee. Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above can help you with steps three and four but its also a good idea to either. Illinois Hourly Paycheck Calculator.

Paycheck Calculator Take Home Pay Calculator

Istudy Bookkeeping And Payroll Services Are Common In Eve Payroll Accounting Payroll Bookkeeping

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

How To Get An Accounting Job With No Experience Bookkeeping Services Accounting Firms Business Loans

7 Common Payroll Mistakes And How To Avoid Them Softwaresuggest Payroll Payroll Software Payroll Taxes

Aflac Supplemental Insurance Information Aflac Aflac Insurance Insurance

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

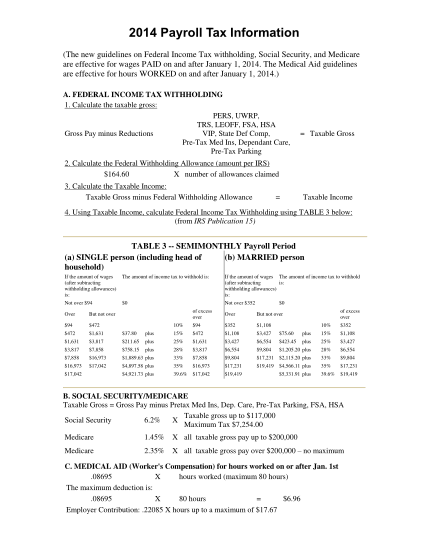

17 Payroll Tax Withholding Calculator Free To Edit Download Print Cocodoc

Paycheck Calculator Take Home Pay Calculator

Pin On Relevant Tax Information Epf

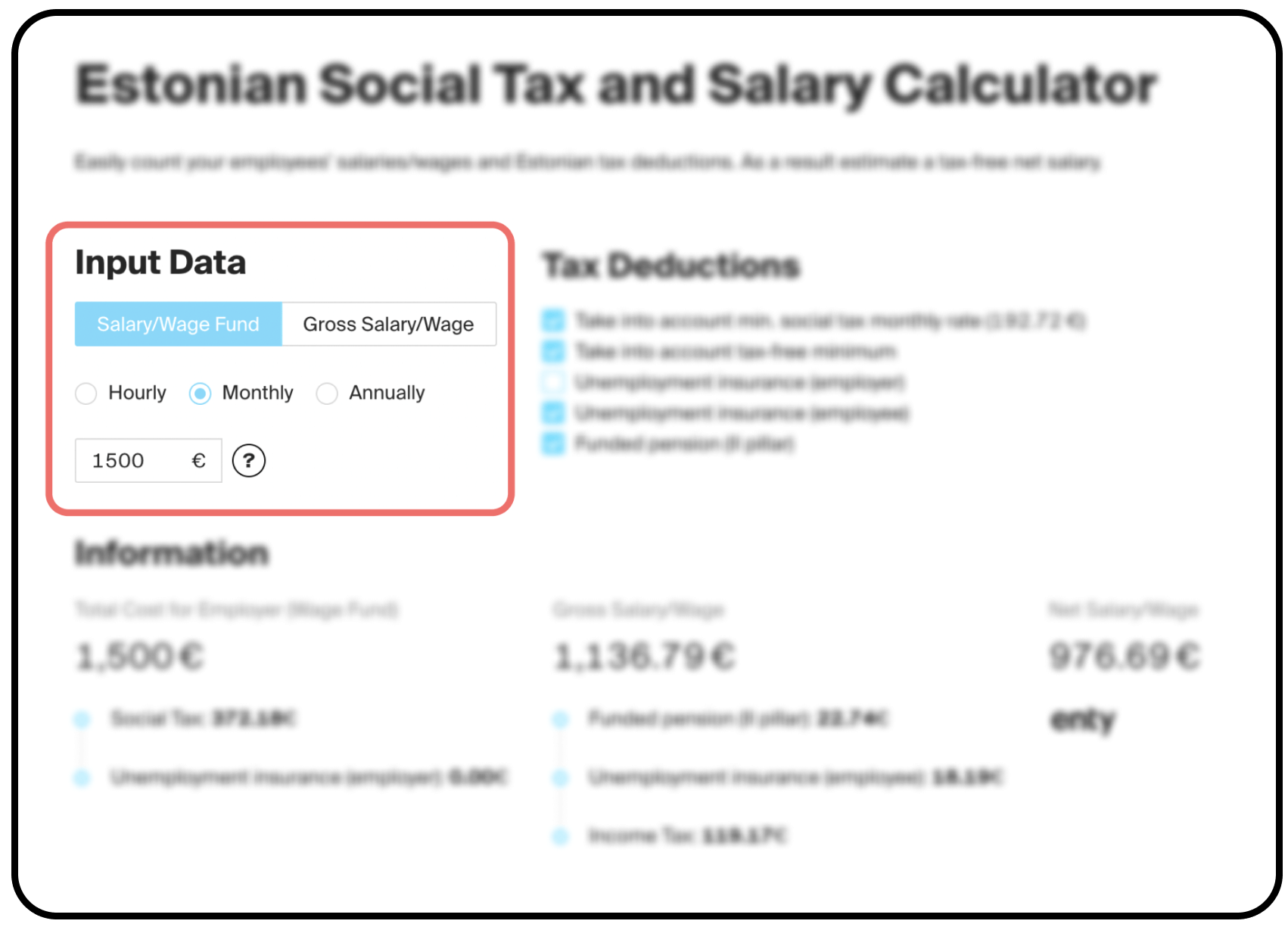

Payroll Deductions Calculator For Estonian Companies Enty

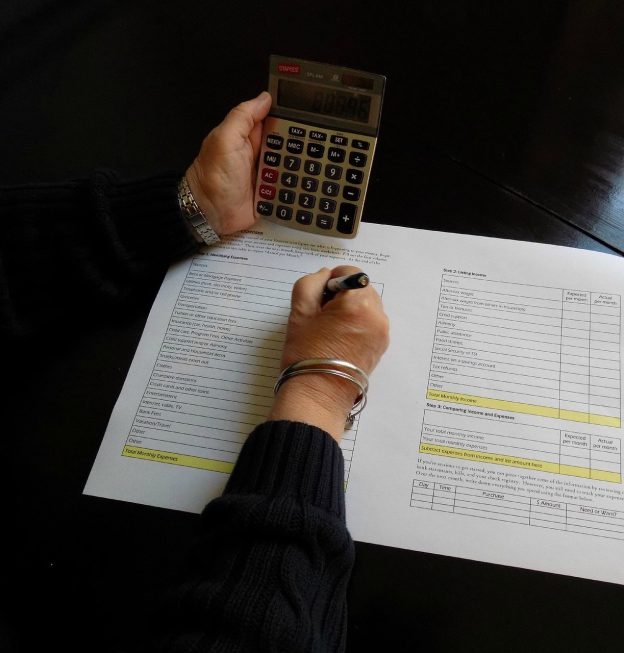

Person Calculating Money Earned Stock Photo Download Image Now Istock

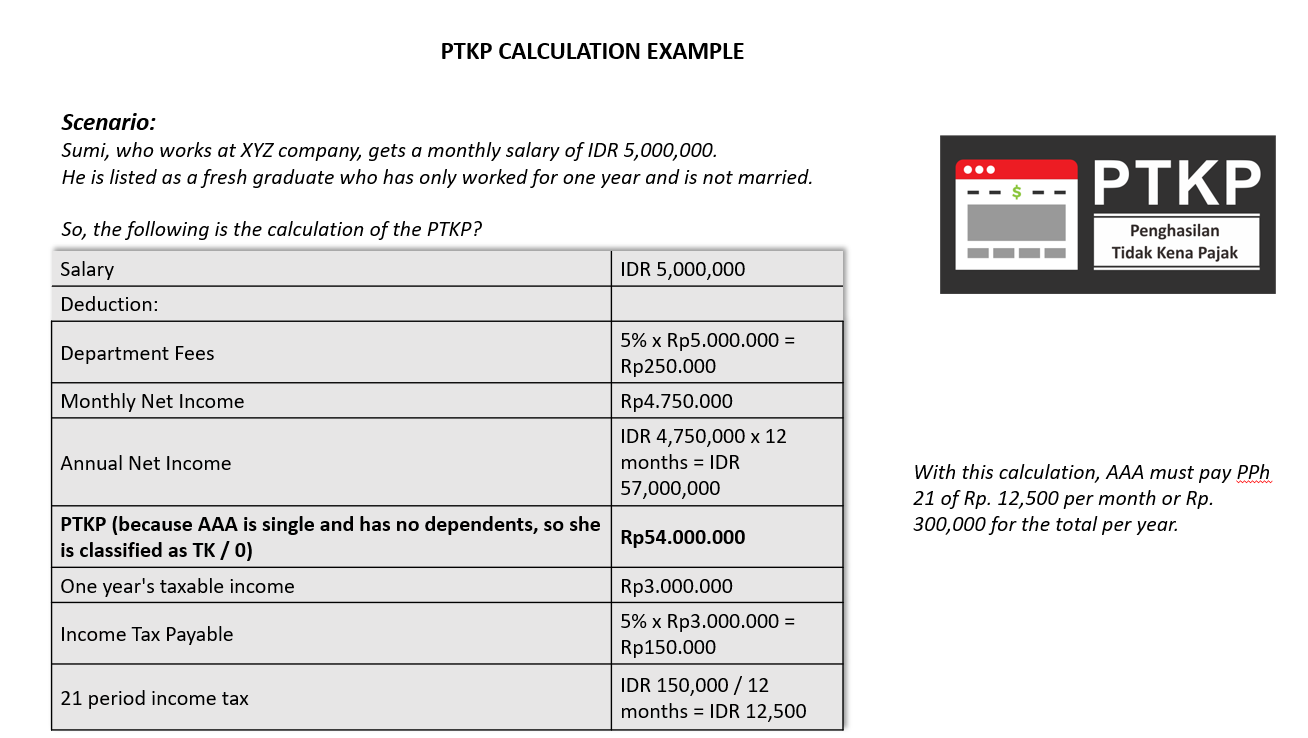

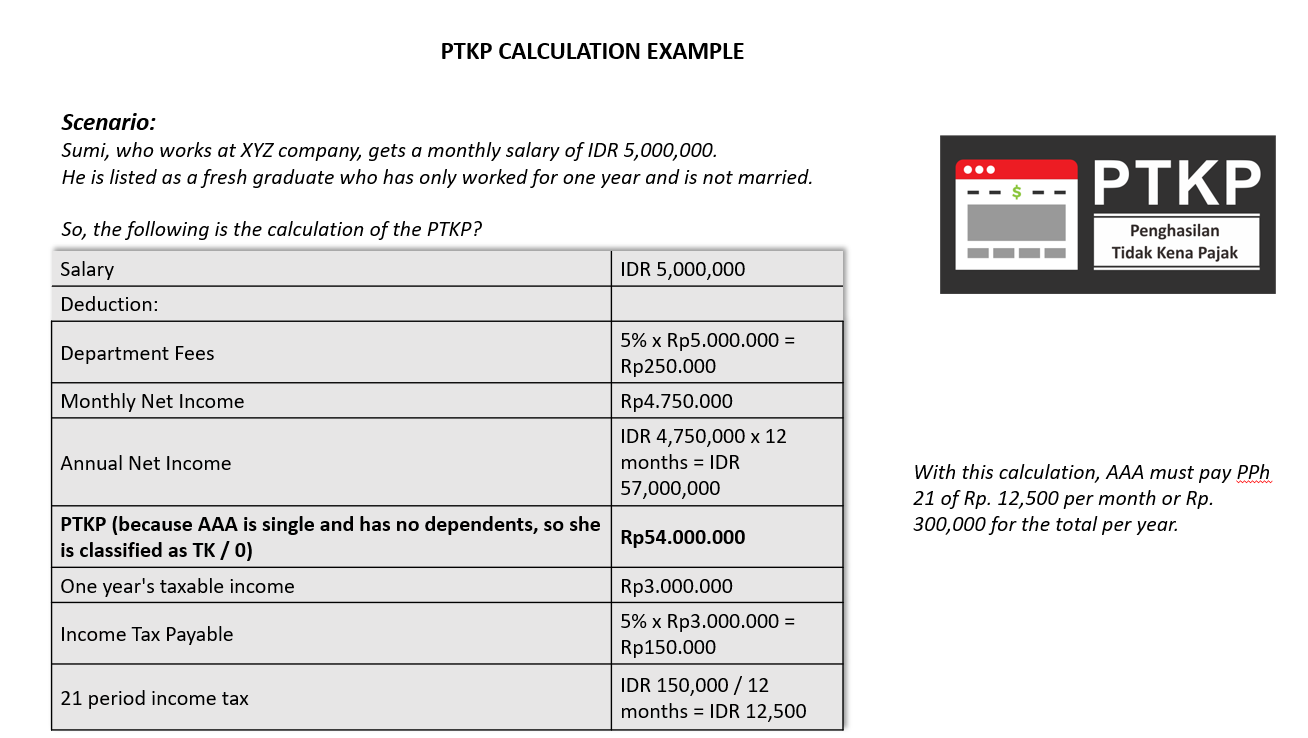

Indonesia Payroll And Tax Guide

Income Tax Calculator Estimate Your Refund In Seconds For Free